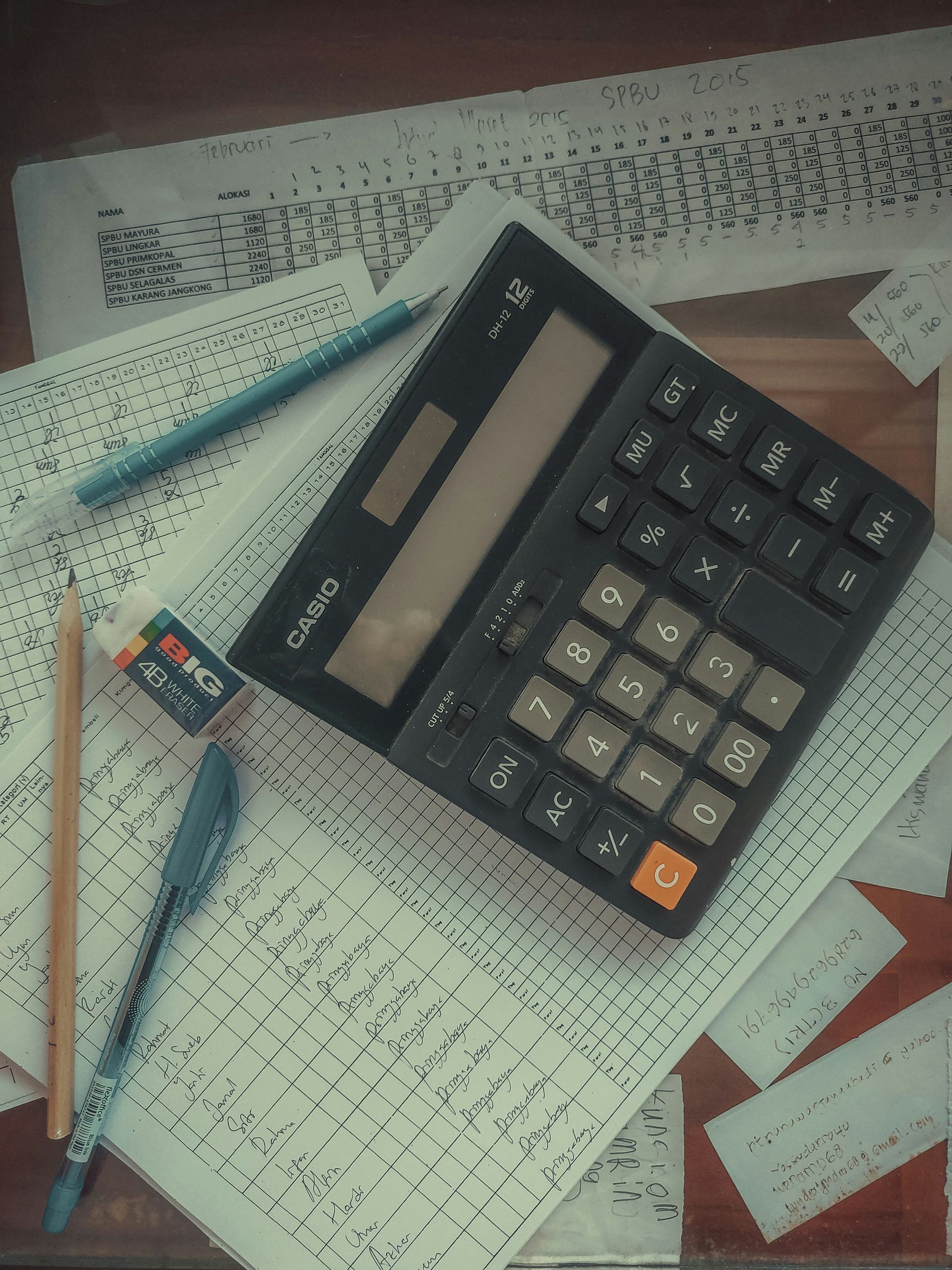

How to Navigate Financial Organization Pitfalls in Entrepreneurship

Starting off on the journey of entrepreneurship can bring both excitement and challenges alike. While creativity, passion, and a strong work ethic are crucial to any business, effective financial organization is equally important for long-term success. There are many financial issues that can arise within a business, and below we will discuss just a few important ways to avoid common financial organization pitfalls.

Create a Financial Calendar

Deadlines for taxes, invoices, and other financial responsibilities can easily be missed without proper organization. By maintaining a financial calendar, entrepreneurs can stay on top of due dates and prevent unnecessary penalties.

Regularly Reconcile Financial Statements

Reconciliation helps identify discrepancies and errors in financial records. Monthly reconciliation of bank statements, invoices, and receipts ensures accuracy, making it easier to catch potential issues early.

Invest in Financial Education

Entrepreneurs may not be financial experts, but a basic understanding of financial concepts is essential. Books, online courses, and seminars can help entrepreneurs make informed decisions and communicate effectively with financial professionals.

Monitor and Control Expenses

Overspending can harm a business's financial health. Entrepreneurs should create a budget, analyze expenses regularly, and identify areas where cost-cutting is possible without compromising quality.

Implement an Effective Bookkeeping System

Setting up a reliable bookkeeping system helps track income, expenses, and profits accurately. Using accounting software can streamline this process, making it easier to generate financial reports for analysis.

Periodically Review Financial Goals

Entrepreneurship is a dynamic journey, and financial goals should evolve accordingly. Regularly reviewing and adjusting financial goals based on business performance and market changes is crucial for staying on track.

Starting a business journey comes with many trials and achievements. Determination is important, but organized finances are crucial for the long-term growth and health of your business. There are many ways to overcome financial hurdles, especially when you are aware of what may come beforehand. Take these steps to ease your company’s financial journey, and remember that entrepreneurship has its ups and downs, but can be extremely rewarding.

THIS ARTICLE IS FOR GENERAL INFORMATION PURPOSES ONLY. BUSINESS FINANCIALS, INC. (BFI) IS NOT ISSUING SPECIFIC FINANCIAL OR TAX ADVICE. PLEASE CONSULT WITH A LICENSED FINANCIAL PLANNER, TAX ATTORNEY, OR ACCOUNTANT FOR ASSISTANCE WITH YOUR SPECIFIC SITUATION. IF YOU NEED HELP, WE INVITE YOU TO CONTACT US. WE WILL BE HAPPY TO MAKE RECOMMENDATIONS OR REFER YOU TO A LICENSED PROVIDER WHO MAY BE BEST SUITED FOR YOUR SITUATION.

Sources